华为科技股票再次在A股主板上破发 华为科技自2019年11月在A股主板上市以来,股价表现一直波动不定。2021年7月,华为科技股价再次破发,引起市场...

2023-11-10 1717

In recent years, machine learning techniques have gained immense popularity due to their successful application in various fields. One such field which has seen tremendous growth in the application of machine learning techniques is the stock market. Stock market prediction has always been a fascination for investors as it allows them to make informed decisions about buying and selling stocks. Machine learning techniques have shown promising results in predicting stock prices. In this paper, we will provide a literature review of the application of machine learning in predicting stock prices.

A lot of research has been done in the field of stock market prediction using machine learning techniques. One such research by Brown and Cliff (2003) used a combination of neural networks and technical analysis to predict stock prices. The study showed that neural networks were better at predicting short term stock prices while technical analysis was better at predicting long term stock prices. Another study by Tsai and Hung (2010) used an adaptive neural network with fuzzy time series to predict stock prices. The results showed that their model outperformed traditional time series models in predicting stock prices.

There are several types of machine learning techniques used in predicting stock prices. One such technique is regression analysis which is used to predict the linear relationship between a dependent variable and independent variable. Another technique is decision tree which is used to predict the outcome based on a set of conditions. Neural networks are also widely used in predicting stock prices where the network learns from past data to make predictions. Support vector machines (SVMs) are another popular machine learning technique used to predict stock prices. SVMs are used to find the best separation boundary between different classes of data.

Despite the promising results of using machine learning techniques in predicting stock prices, there are several challenges and limitations. One of the main challenges is the availability of data. Stock prices often fluctuate rapidly and it is difficult to capture and interpret all the relevant data. Another challenge is the complexity of the stock market which involves numerous factors such as market trends, economic indicators, and geopolitical events. These factors make it difficult to accurately predict stock prices using machine learning techniques.

In conclusion, the application of machine learning techniques in predicting stock prices has gained immense popularity due to their successful results. Previous research has shown that various machine learning techniques can be used to predict stock prices with varying degrees of accuracy. However, there are several challenges and limitations in using these techniques which need to be addressed. Further research needs to be done to improve the accuracy of these techniques and overcome the limitations and challenges that exist in the field of stock market prediction.

相关文章

华为科技股票再次在A股主板上破发 华为科技自2019年11月在A股主板上市以来,股价表现一直波动不定。2021年7月,华为科技股价再次破发,引起市场...

2023-11-10 1717

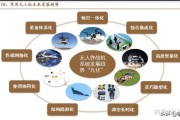

未来无人机技术发展趋势 随着科技的不断发展,无人机行业也在迅速崛起,并成为了各个领域的热门话题。和人类的生活息息相关,无人机广泛应用于农业、物流、采...

2023-11-10 1755

简介 科技已经成为人类生活中不可或缺的一部分,我们身边的许多日用品和服务都离不开科技的帮助。作为小学一、二年级的孩子,我们也开始学习并了解科技的基本...

2023-11-10 1839

3-6年级科幻世界画展 近日,在市中心的美术馆内,一场名为“3-6年级科幻世界画展”的展览热闹开展。这次展览由市教委主办,旨在展示小学生们的创意和想...

2023-11-10 1704

1 6年级儿童科幻画图片大全 六年级孩子们有创意无限,在科幻画方面更是有着大量的天赋。他们喜欢创造自己的世界,想象未来的科技和生活,表达自己内心的梦...

2023-11-10 1693

科技,闪耀未来 科技的进步,是人类历史上最为惊人的成就之一。从最早的石器时代,到现在的数字时代,科技发展成果早已深入人们的生活方方面面,改变着人们的...

2023-11-09 1712

2021年科技新突破:关注人工智能 2021年,人工智能在各行各业得到了不断的应用和创新,许多技术领域都推动了人工智能的发展。例如,自然语言处理技术...

2023-11-09 250

2022年十大科技成就:颠覆未来科技生态 2022年是科技发展的巨变之年,许多颠覆性的科技成果将在这一年进一步落地和商用,在推动各行各业的发展进程中...

2023-11-09 240

发表评论